In today’s fast-paced world, the journey of automobile ownership is influenced by a complex web of finance and insurance. As we navigate through the intricacies of purchasing and maintaining a vehicle, understanding these elements becomes essential for making informed decisions. This is especially true with the rise of technology and information platforms that provide valuable resources for consumers. From budgeting for a new car to selecting the right insurance coverage, each step can significantly impact your overall experience and financial well-being.

At newamc, we strive to offer the latest insights and expert guidance on these critical aspects of automobile ownership. Our mission is to empower individuals with the information they need to navigate the ever-evolving landscape of finance, insurance, and education related to vehicles. Whether you are a first-time buyer or looking to enhance your knowledge, we are here to help you drive your future with confidence. Join us as we explore how these factors shape the game of owning and enjoying an automobile.

Understanding Automobile Financing

When considering purchasing a vehicle, understanding automobile financing is essential. Financing options can significantly impact your overall cost of ownership and monthly budget. Most buyers have the option of obtaining a loan from a bank, credit union, or the dealership itself, with various terms and interest rates. Evaluating these options requires careful consideration of factors such as your credit score, the length of the loan, and the total interest paid over time.

One common financing method is to secure a traditional auto loan. This involves borrowing a specific amount of money to purchase a vehicle, which is then repaid over a predetermined period. It’s crucial to calculate your monthly payments and understand how different loan terms affect the overall cost. Additionally, some dealerships offer special financing promotions that might provide lower interest rates or deferred payments, making it worthwhile to shop around and compare options.

Another aspect to consider is leasing a vehicle, which is an alternative to traditional financing. Leasing typically requires lower monthly payments and can provide access to newer models more frequently. However, it often comes with mileage restrictions and potential penalties for excessive wear and tear. Understanding the intricacies of both buying and leasing will help you make an informed decision that best suits your financial situation and driving needs.

The Role of Insurance in Vehicle Ownership

Insurance serves as a crucial safety net for vehicle owners, providing financial protection in the event of accidents, theft, or damage. When you invest in a vehicle, the accompanying insurance coverage ensures that you are not left vulnerable to overwhelming repair costs or liability claims. By paying a manageable premium, owners can mitigate potential losses and gain peace of mind knowing they are safeguarded against unforeseen circumstances.

Moreover, insurance influences the overall cost of vehicle ownership significantly. Factors such as the type of vehicle, driving history, and location can affect insurance premiums. This means prospective buyers must consider insurance costs when budgeting for a new car. By understanding how different insurance policies work, owners can seek out the best coverage that fits their needs while keeping expenses in check, ultimately leading to a smarter financial decision.

Additionally, insurance can impact the desirability and resale value of a vehicle. Cars with higher safety ratings often come with lower insurance premiums, making them more appealing to buyers. Insurance can also incentivize responsible driving behaviors, as policyholders may receive discounts for safe driving records. Thus, understanding the interplay between insurance and vehicle ownership not only affects current expenses but also plays a pivotal role in long-term value and satisfaction.

Maximizing Your Automotive Investment

Investing in a vehicle is often one of the largest financial commitments individuals make, and maximizing that investment requires careful planning and consideration. When selecting a car, it is crucial to research the vehicle’s resale value, maintenance costs, and insurance premiums. Opting for a model known for its durability and reliability can significantly enhance your long-term investment, as these vehicles tend to hold their value better over time.

How to budget for school supplies

Financing options play a pivotal role in optimizing your automotive investment. Shopping around for the best interest rates and terms can lead to substantial savings. Additionally, considering factors such as loan duration and down payment can influence the overall cost of ownership. Engaging with financial professionals or using resources like newamc can provide insights into effective financing strategies tailored to your specific situation.

Lastly, integrating the right insurance policy is vital in protecting your investment. Comparing quotes from various insurers ensures you choose a plan that covers your needs without overspending. Understanding the impact of factors like your driving history, vehicle type, and coverage limits can lead you to the most cost-effective insurance solution. By diligently managing your financing and insurance, you can significantly enhance the value derived from your automotive investment.

Navigating Financial Products for Cars

When it comes to acquiring a vehicle, understanding the various financial products available is crucial for making informed decisions. There are several options, including traditional auto loans, leasing, and certified pre-owned vehicle financing. Each option has its own set of benefits and drawbacks, so it’s important to evaluate your personal budget, driving habits, and long-term goals. By comparing interest rates, loan terms, and monthly payments, you can find a package that aligns with your financial situation.

Another vital aspect of financing a car is the impact of your credit score. Lenders will assess your credit history to determine the interest rates and loan terms you qualify for. A higher credit score generally leads to better rates, which can save you significant amounts over the life of the loan. It’s beneficial to review your credit report prior to applying for financing to ensure all information is accurate and to address any issues that may negatively affect your score.

Finally, exploring additional services such as gap insurance or extended warranties can enhance your financial strategy. Gap insurance covers the difference between what you owe on a vehicle and its depreciated value in case of a total loss. Extended warranties can offer peace of mind by protecting you from unforeseen repair costs. Educating yourself on these products will empower you to make choices that not only fit your current needs but also secure your financial future in the realm of automobile ownership.

Future Trends in Automotive Finance and Insurance

The future of automotive finance and insurance is likely to be heavily influenced by technological advancements and shifting consumer preferences. As electric vehicles and autonomous driving technologies become more mainstream, financial institutions and insurance companies will need to adapt their products and services accordingly. Financing options for electric vehicles may include incentives for environmentally friendly choices, while insurance models could focus on the unique risks associated with autonomous driving, such as liability and cybersecurity threats.

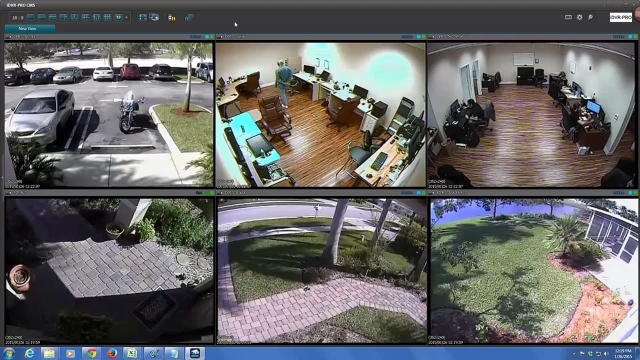

Digital transformation will continue to shape the landscape of automotive finance and insurance. The rise of online platforms and mobile apps is making it easier for consumers to compare financing options and insurance policies, leading to a more competitive market. Real-time data from connected vehicles will enable insurers to offer personalized policies based on driving behavior, encouraging safer driving practices and potentially reducing premiums for low-risk drivers.

Moreover, the integration of gamification in finance and insurance is expected to enhance consumer engagement. By incorporating game-like elements into financial education and insurance management, companies can motivate consumers to make informed decisions about their automobile ownership experience. This innovative approach not only fosters financial literacy but also creates an interactive environment that can lead to better understanding and utilization of financial and insurance products.