Welcome to the world of wealth management, an art that requires precision, strategy, and a deep understanding of personal financial planning. In this comprehensive guide, we will delve into the realm of mastering the art of wealth. From creating a solid financial foundation to making informed investment decisions, we will explore the key principles and practices that can lead to successful wealth management.

In today’s rapidly changing economic landscape, it has become more crucial than ever to have a clear roadmap for personal financial planning. The task of managing wealth goes beyond accumulating money; it involves setting achievable goals, navigating risks, and maximizing opportunities. Whether you are just starting your financial journey or looking to refine your existing wealth management strategy, this guide aims to equip you with the knowledge and tools needed to take control of your financial future.

Throughout this article, we will unravel the intricacies of wealth management and provide practical insights on how to make the most of your resources. From establishing a budget and managing debt to building an investment portfolio and planning for retirement, each step plays a vital role in securing your financial well-being. By adopting a comprehensive approach to wealth management, you can lay the foundations for financial security, establish a strong financial legacy, and ultimately create a life filled with abundance.

So, let us embark on this journey together, as we uncover the art of wealth management and guide you towards a successful and prosperous future. Get ready to unlock the secrets of personal financial planning and unleash your true potential in the realm of wealth management.

Setting Financial Goals

In order to achieve successful wealth management, it is crucial to start by setting clear and achievable financial goals. Setting financial goals provides a roadmap for your financial journey and helps you stay focused and motivated.

The first step in setting financial goals is to assess your current financial situation. Take a close look at your income, expenses, assets, and liabilities. This will give you a clear understanding of where you stand financially and what areas you need to focus on.

Once you have a clear picture of your current situation, it’s time to define your short-term and long-term financial goals. Short-term goals are those that you can achieve within a year or two, while long-term goals are those that may take several years or even decades to accomplish.

When setting your financial goals, it’s important to be specific and realistic. Avoid setting vague goals such as "become rich" or "make a lot of money." Instead, set specific goals like "save $10,000 for a down payment on a home within the next two years" or "increase my retirement savings by 15% annually."

Additionally, it’s essential to prioritize your financial goals. Determine which goals are most important to you and align them with your values and aspirations. This will help you stay motivated and make better financial decisions.

Remember, setting financial goals is just the first step. Regularly review and reassess your goals to ensure they remain relevant and achievable. As your circumstances change, your goals may need to be adjusted accordingly. With a clear set of financial goals, you’ll be better equipped to navigate the path towards successful wealth management.

Developing a Comprehensive Wealth Management Plan

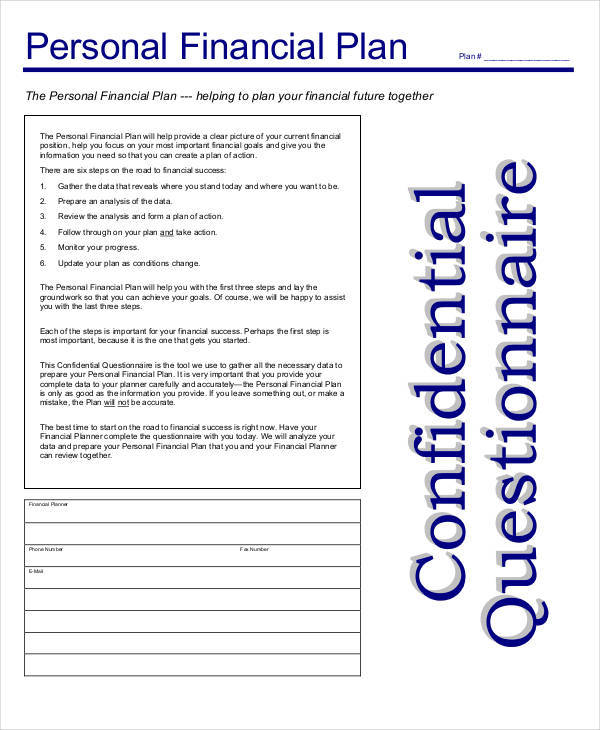

A successful wealth management plan requires careful consideration and a thoughtfully crafted approach. By aligning your personal financial planning with your long-term goals, you can create a solid foundation for building and preserving wealth. Here are three key steps to develop a comprehensive wealth management plan:

Assessing Your Current Financial Situation: The first step in creating a wealth management plan is to assess your current financial situation. This involves taking stock of your assets, liabilities, income, and expenses. By gaining a clear understanding of your financial standing, you can identify areas for improvement and set realistic goals. Consider seeking professional guidance, such as consulting with a financial advisor, who can help you analyze your financial situation comprehensively.

Setting Financial Goals: Once you have a clear understanding of your current financial situation, the next step is to set specific financial goals. These goals should be aligned with your long-term vision for wealth creation and preservation. Whether it’s saving for retirement, funding your children’s education, or building an emergency fund, clearly define your objectives and establish a realistic timeline for achieving them. Having well-defined financial goals will provide you with a clear roadmap for your wealth management journey.

Implementing Strategies and Monitoring Progress: After setting your financial goals, it’s time to develop strategies to achieve them. This may involve diversifying your investment portfolio, minimizing taxes, and managing risk effectively. It’s crucial to regularly review and adjust your strategies as you progress toward your goals. Monitoring your progress and making necessary changes will ensure that your wealth management plan remains effective and aligned with your evolving needs.

By following these steps and continuously reassessing your financial situation, you can develop a comprehensive wealth management plan that optimizes your financial well-being. Keep in mind that wealth management is a dynamic process, and it’s important to stay informed about market trends and adapt your strategies accordingly. With a well-structured plan in place, you’ll be better positioned to navigate the complexities of wealth management and achieve long-term financial success.

Implementing Effective Wealth Management Strategies

Effective wealth management strategies are essential for achieving long-term financial success. By implementing the right strategies, individuals can take control of their personal financial planning and secure a prosperous future. Here are three key steps to help you master the art of wealth management:

Best Countries For Black Women To LiveSet Clear Financial Goals:

Before diving into wealth management, it’s crucial to define your financial goals. Start by assessing your current financial situation and determining where you want to be in the future. Are you looking to build a retirement nest egg, save for your children’s education, or achieve financial independence? Setting clear and specific goals will provide the foundation for developing a successful wealth management plan.Diversify Your Investments:

Diversification is a fundamental principle in wealth management. Spread your investments across different asset classes such as stocks, bonds, real estate, and commodities. This strategy helps mitigate risks and allows you to capitalize on growth opportunities. By diversifying, you reduce the impact of any single investment’s performance on your overall portfolio. Remember, the key is to create a fine balance between risk and reward to maximize returns.Regularly Review and Adjust Your Plan:

Wealth management is an ongoing process that requires active monitoring and periodic adjustments. Keep a close eye on your investments, regularly review your financial goals, and assess any changes in your circumstances. As your financial situation evolves, you may need to rebalance your portfolio, reallocate assets, or make other necessary adjustments. A proactive approach to reviewing and adjusting your wealth management plan will ensure that it remains aligned with your changing needs and market conditions.

By following these steps and implementing effective wealth management strategies, you can take charge of your financial future and work towards achieving your long-term goals. Personal financial planning and sound wealth management go hand in hand, providing you with the roadmap to attain financial stability, security, and prosperity.