Digital asset legislation plays a crucial role in shaping the landscape of the digital economy. As the use of cryptocurrencies and blockchain technology continues to expand, the need for clear and effective regulatory frameworks becomes increasingly important. This legislation aims to provide clarity, protect consumers, and foster innovation while addressing potential risks associated with digital assets. Understanding these laws is essential for individuals and businesses alike, as they navigate the complexities of digital finance.

Overview of Digital Asset Legislation

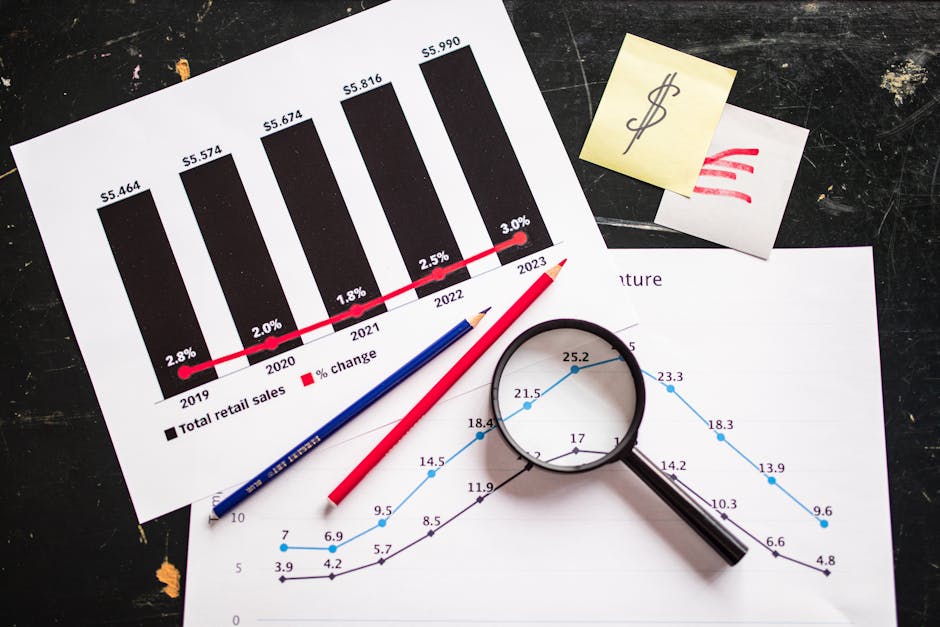

Digital asset legislation encompasses a wide range of laws and regulations that govern the use, exchange, and issuance of cryptocurrencies and other digital assets. These regulations vary significantly across jurisdictions, reflecting differing attitudes towards digital currencies and blockchain technologies. In many cases, legislation aims to mitigate risks related to fraud, money laundering, and consumer protection while encouraging the growth of the digital economy. The primary importance of digital asset legislation lies in its ability to establish a legal framework that fosters trust among users and investors. By providing clear guidelines, legislators can help create an environment where innovation can thrive, while also ensuring that risks are managed effectively. As the digital asset market evolves, ongoing discussions about the nature of these assets and their classification—whether as commodities, securities, or currencies—continue to shape regulatory approaches.

Key Regulations Impacting Cryptocurrencies

Across various jurisdictions, several key regulations have emerged that specifically impact cryptocurrencies. These regulations often focus on issues such as anti-money laundering (AML), know your customer (KYC) requirements, taxation, and consumer protection. One notable example is the European Union’s Fifth Anti-Money Laundering Directive (5AMLD), which extends AML regulations to virtual currencies and the exchanges that facilitate their trading. This directive requires that cryptocurrency exchanges implement robust KYC procedures to verify the identities of their users, thus reducing the potential for illicit activities. In the United States, the Financial Crimes Enforcement Network (FinCEN) has issued guidelines that classify cryptocurrency exchanges as money services businesses (MSBs). This classification subjects them to various regulatory requirements, including registration and compliance with AML regulations. Furthermore, certain jurisdictions, such as Switzerland, have developed comprehensive frameworks that not only regulate cryptocurrencies but also encourage innovation. The Swiss Financial Market Supervisory Authority (FINMA) provides clear guidelines for initial coin offerings (ICOs) and has established a regulatory sandbox to support blockchain startups.

Global Perspectives on Blockchain Regulations

The global landscape of blockchain regulation is diverse, with some countries embracing digital assets while others adopt more cautious or restrictive approaches. For instance, nations like Malta and Singapore are recognized for their progressive regulations that promote the growth of blockchain technology and encourage foreign investment. Conversely, countries such as China have taken a more restrictive stance, imposing bans on cryptocurrency trading and initial coin offerings. This approach reflects concerns around financial stability and the potential for capital flight. In addition, some countries focus on developing their own digital currencies, often referred to as central bank digital currencies (CBDCs). These initiatives demonstrate a recognition of the potential benefits of digital assets while aiming to retain control over monetary policy and financial systems. The varied global responses to digital asset legislation highlight the importance of international cooperation and dialogue among regulators. As digital assets continue to evolve, harmonization of regulations may become necessary to address cross-border challenges and foster a more cohesive global market.

| Jurisdiction | Key Regulation | Focus Area |

|---|---|---|

| European Union | 5AMLD | AML, KYC |

| United States | FinCEN Guidelines | MSB Classification |

| Switzerland | FINMA Guidelines | ICO Regulation |

| China | Trading Ban | Financial Stability |

| Malta | Blockchain Act | Innovation Promotion |

As the landscape of digital asset legislation continues to evolve, it remains essential for stakeholders to stay informed about regulatory developments. Understanding the implications of these laws not only helps in complying with legal requirements but also fosters a safer and more trustworthy environment for digital asset transactions. By keeping abreast of the various regulatory frameworks in place around the globe, businesses and individuals can navigate the complexities of the digital economy with greater confidence.