As a business owner, safeguarding your venture is of utmost importance. In a world full of uncertainties, having the right commercial insurance can provide you with the peace of mind you need to focus on running your business effectively. Whether you own a thriving restaurant or operate a fleet of commercial vehicles, commercial insurance serves as a protective shield, shielding you from potential financial losses.

In the vibrant state of California, commercial insurance is a crucial aspect of ensuring the success and longevity of your business. Whether you’re starting a new venture or looking to update your current coverage, understanding the intricacies of commercial insurance is essential. From property and liability insurance to workers’ compensation and business interruption coverage, there are various policies that can be tailored to meet your specific needs.

For California restaurant owners, restaurant insurance is an indispensable tool in safeguarding your establishment against potential risks and liabilities. A comprehensive restaurant insurance policy not only protects your physical assets such as your building, equipment, and inventory, but it also covers you against unexpected incidents such as customer injuries, foodborne illnesses, and liquor liability.

Similarly, for businesses that heavily rely on commercial vehicles, having the right commercial auto insurance is crucial. Whether you operate a small delivery service or manage a large fleet, commercial auto insurance can protect your vehicles, drivers, and cargo from unforeseen accidents, damages, or thefts. With the right coverage, you can ensure the smooth and uninterrupted operation of your business.

In this guide, we will dive deep into the world of commercial insurance in California. We’ll explore the different types of coverage available, the specific requirements for businesses in various industries, and provide valuable insights to help you navigate the complexities of commercial insurance. By the end of this article, you’ll have a comprehensive understanding of commercial insurance in California and be equipped with the tools necessary to safeguard your business effectively. So, let’s get started and embark on this journey into the ins and outs of commercial insurance.

Types of Commercial Insurance Coverage

Business insurance California

Commercial insurance provides essential protection for businesses in California, covering various risks and potential liabilities. It is crucial for business owners to choose the right coverage options to safeguard their operations and assets. Here are some key types of commercial insurance coverage to consider:

General Liability Insurance: This type of coverage protects businesses from third-party claims for bodily injury, property damage, and advertising or personal injury. It typically covers legal expenses, medical bills, and settlements or judgments if your business is found liable for the damages.

Property Insurance: Property insurance covers physical assets such as buildings, inventory, equipment, and furniture in case of damage or loss due to perils like fire, theft, vandalism, or natural disasters. This coverage ensures that you can rebuild or repair your property without suffering significant financial loss.

Commercial Auto Insurance: If your business uses vehicles for deliveries, transportation, or other company operations, it is crucial to have commercial auto insurance. This coverage protects your vehicles and drivers in case of accidents, damages, or injuries that may occur on the road. It typically covers liability, collision, and comprehensive damages.

Remember, this is only the starting point when it comes to commercial insurance coverage. Based on your specific business needs, you may also need additional types of coverage such as workers’ compensation, cyber liability insurance, or professional liability insurance. Consulting with an experienced insurance agent can help you tailor the right coverage package for your business in California. Stay tuned for the next section where we will explore the intricacies of restaurant insurance in California.

Key Considerations for Restaurant Insurance in California

Owning a restaurant in California can be an exciting venture, but it also comes with its fair share of risks. That’s why having the right insurance coverage is crucial to safeguarding your business and its assets. Here are a few key considerations to keep in mind when exploring restaurant insurance options in California.

Understanding general liability insurance: General liability insurance is a fundamental coverage that every restaurant owner should have. It protects your business from claims related to property damage, bodily injury, or personal injury that may occur on your premises. In an industry where accidents can happen, having this coverage in place can provide peace of mind and financial protection.

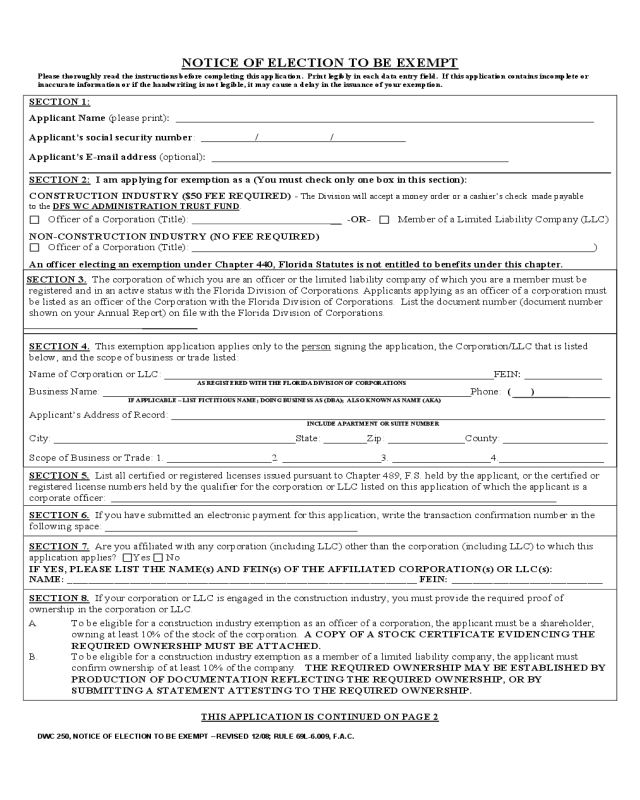

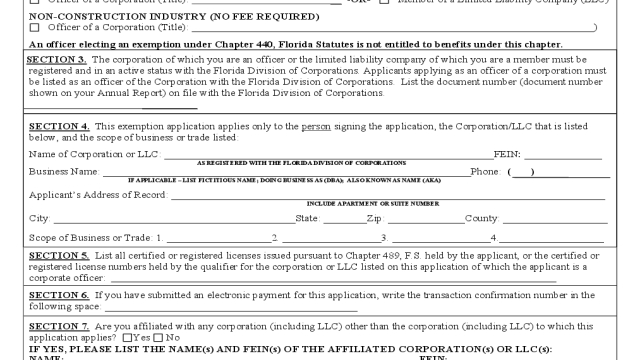

Worker’s compensation coverage: When running a restaurant, you rely heavily on your employees to keep the operation running smoothly. It’s essential to prioritize their well-being and ensure you have the necessary worker’s compensation coverage. This type of insurance provides benefits to employees who may sustain work-related injuries or illnesses. Compliance with California’s worker’s compensation laws is critical to avoid potential legal issues.

Commercial property insurance: The restaurant industry involves significant investments in equipment, inventory, and the physical space itself. Protecting these valuable assets is vital, and commercial property insurance can help cover losses due to fire, theft, vandalism, or other unforeseen events. Make sure to consider the replacement cost and business interruption coverage when choosing your policy.

Remember, every restaurant is unique, and your insurance needs may vary based on factors such as the size of your establishment, the number of employees, the type of cuisine, and your location within California. Consulting with an experienced insurance agent who specializes in restaurant insurance can help you navigate these considerations and tailor coverage that suits your specific requirements.

Understanding Commercial Auto Insurance in California

When it comes to running a business in California, having a good commercial auto insurance policy is crucial. Whether you own a fleet of vehicles for deliveries or just a single company car, protecting your assets and ensuring that your drivers are covered is essential.

Commercial auto insurance in California provides coverage for vehicles used for business purposes. This can include various types of vehicles such as cars, trucks, vans, and even motorcycles. The insurance policy typically includes liability coverage, which protects your business if your driver is at fault in an accident and causes damage to other people’s property or injures someone.

In addition to liability coverage, commercial auto insurance also offers comprehensive coverage. This coverage protects your vehicles from damage caused by theft, vandalism, or natural disasters. It’s important to note that commercial auto insurance policies can be customized based on the specific needs of your business, allowing you to tailor the coverage to match your requirements.

Having commercial auto insurance gives you peace of mind knowing that your business is protected in case of unforeseen accidents or incidents. By investing in a comprehensive policy, you can safeguard your vehicles, drivers, and ultimately, your business’s financial stability.

Remember, California regulations may require businesses to carry a certain minimum amount of commercial auto insurance coverage. It’s essential to familiarize yourself with the state’s insurance requirements and work with a reputable insurance provider who understands the unique needs of your business to ensure proper coverage.