It is a very simple process cash credit card of buyer is taken by the wireless cleaner. As soon as merchant account square entered the card number along with the related details is send towards terminal. With the terminal it reaches the processor and the processor forwards all info to the lender. It is checked whether the and quantity of entered is valid or not ever. Accordingly the bank sends a response either with the approval number or decrease the exchange.

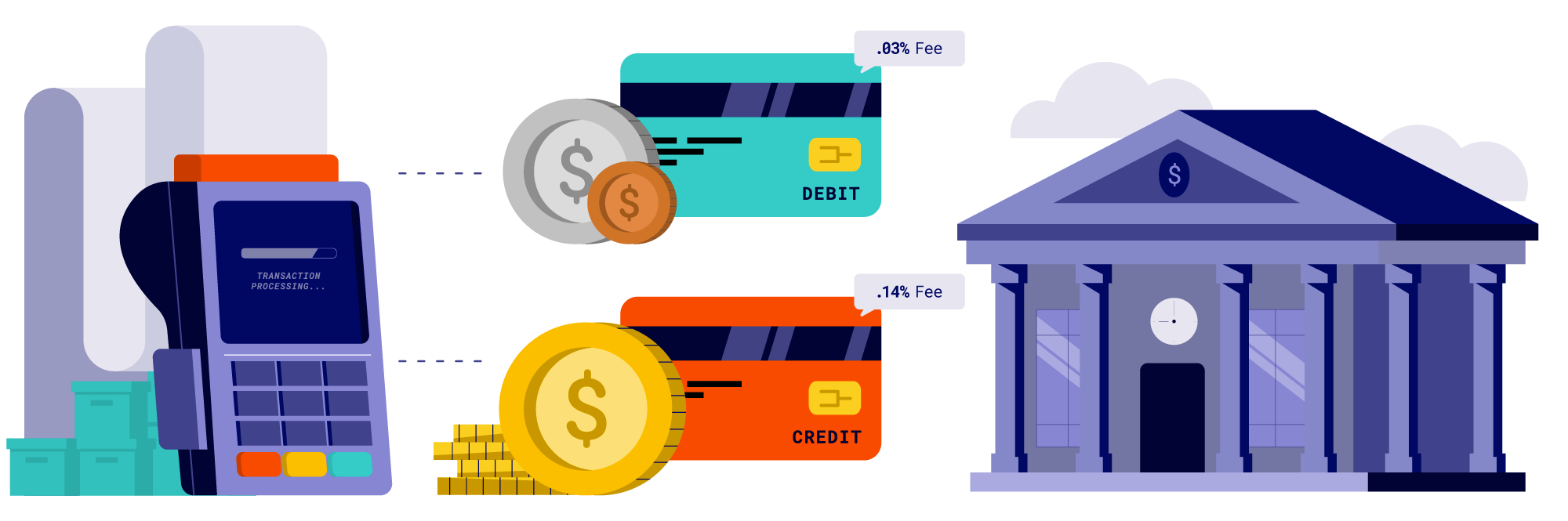

The reason is that the processor is not compelled legally to reduce their rates that it will cost you. Let’s imagine you got your merchant services from among the big membership club stores or even your credit. You are paying 1.64% and $0.20 per debit transaction. Prior to when the Durbin Act, your processor was paying about 1% $0.20 per transaction to the cardholder’s side. Now, after the Durbin Act, your processor has only to pay 0.05% $0.22 per cost. The savings difference of 0.95% is actually you or perhaps for the processor to keep if you won’t act.

This information and facts is taken from credit card machine that can take a few more minutes to complete the cost. But if the network is busy or server is down all of the information is stored the actual machine and can also be accessed anytime.

Be careful of free terminal offers. Like the sayings go, you get what shell out for right now there are no free promises. Credit card terminals are not free to the processor and the processor will guarantee it gets to be a return on your “free” terminal it gave to you. Find out what that cost is in fact. The cost could be an obsolete terminal, a long-term commitment, or excessive penalties for non-return of it technology.

So let’s go into detail exactly how to credit processing works. Well, first of all, credit score company would look increase records. You bet! Your records of previous card membership. They will also view your bank records. Such manner hands the company the in order to asses your capability and reliability. Will the company be in the trust the customer? Do you have a bad record to give them the right to reject software? How much is your worth to acquire a credit trading card? This stage of credit processing would let the company evaluate if you definitely prompt payer or never.

Small businesses have received the biggest reduction in their credit card processing charges in a history of the electronic payment industry, take in the amount they are positioned up competently.

This is specially true for merchants are generally on three-tier and enhanced bill back pricing. To do this group, the processor is not compelled by law to reduce the rates and only reduces your interchange rate and not the Visa/MasterCard Assessment along with the processor’s %. In essence, in the event a merchant is paying 1st.64% $0.20 per debit transaction, primary difference of three.95% to 0.05% gets to the processor, not into the merchant.

There are legion independent credit card processing organizations (ISO) that offers IC Plus pricing. Veggies take them up for their offer. There are a number reputable ISO’s in industry industry.