In today’s fast-paced world, convenience is a key factor that shapes our daily lives. One of the most significant innovations that has revolutionized personal finance is the Automated Teller Machine, commonly known as the ATM. These machines have become a familiar presence in our cities and towns, providing not only easy access to cash but also a range of banking services that can be utilized at any hour of the day. From their humble beginnings to the advanced technology of today, ATMs have transformed the way we manage our money.

ATM Gwinnett

The evolution of ATMs has had a profound impact on our lifestyle and financial interactions. In Georgia, for instance, companies like ATMgeorgia are at the forefront of this evolution, specializing in cash loading and installation services. By facilitating seamless transactions, ATMs have contributed significantly to the accessibility of banking services, making them invaluable in our day-to-day lives. As we explore the past, present, and future of ATMs, it becomes clear that they are more than just machines; they are a vital link in our financial ecosystem.

The History of ATMs

The concept of the automated teller machine, or ATM, began to take shape in the 1960s as a response to the growing need for convenient banking services. The first functional ATM was deployed by Barclays Bank in London in 1967, allowing customers to withdraw cash without the need for a bank teller. This innovation transformed the way people interacted with their finances, ushering in the era of self-service banking. The original machines dispensed tokens instead of cash and were limited in functionality compared to modern ATMs.

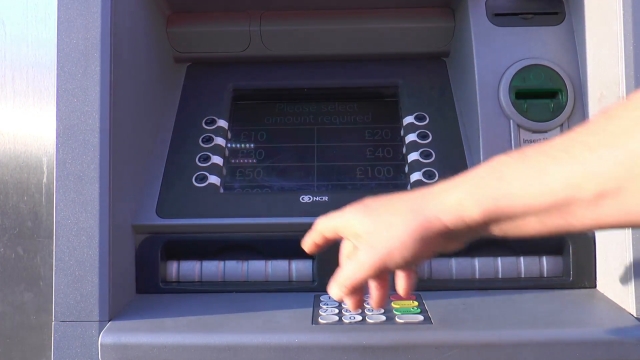

Throughout the 1970s and 1980s, ATMs gained popularity across various countries. As financial institutions embraced this technology, the machines evolved to include features like deposit capabilities and account information access. Companies like NCR and Diebold played pivotal roles in manufacturing and expanding ATM networks. By the end of the 1980s, the number of ATMs had skyrocketed, with thousands of machines dotting urban landscapes and rural areas alike, making banking more accessible to millions.

The 1990s marked a turning point in ATM technology with the introduction of electronic banking and the internet. This allowed ATMs to connect to broader banking networks, enabling advanced functionalities such as balance inquiries and multi-currency withdrawals. With the emergence of card-based transactions, more customers began relying on ATMs for everyday banking needs. The evolution of ATMs not only changed personal finance management but also set the stage for future innovations in electronic payments and banking convenience.

The Role of ATMgeorgia in the Market

ATMgeorgia stands out as a significant player in the ATM sector, offering a range of services that cater to the growing need for accessible cash solutions. As an ATM company, it not only provides machines but also ensures they are consistently stocked with cash, thus facilitating smooth transactions for users. Their commitment to processing cash loads efficiently means that customers can rely on ATMgeorgia for dependable access to their cash needs in various locations.

Additionally, the installation and de-installation services offered by ATMgeorgia further enhance their market presence. By managing the full lifecycle of ATM machines, from setting them up at strategic locations to removing them when they are no longer in service, ATMgeorgia ensures that retailers and business owners face minimal disruption. This comprehensive approach not only appeals to new clients looking to partner with a reliable ATM provider but also fosters long-term relationships within the industry.

Moreover, ATMgeorgia’s understanding of regional market dynamics allows them to tailor their services effectively. By analyzing trends and customer preferences, they can place ATMs in high-demand areas, maximizing user convenience. This strategic placement initiative supports both local economies and the company’s growth, reinforcing ATMgeorgia’s pivotal role in enhancing the accessibility of cash services in the community.

Technological Advancements in ATMs

In recent years, ATMs have seen a significant transformation driven by technological advancements. From basic cash dispensing machines to sophisticated systems, the evolution has improved user experience and safety. Today’s ATMs incorporate features such as touch screens, biometric authentication, and contactless transactions. These innovations allow users to access their accounts more securely and conveniently, making transactions quicker and reducing the time spent at the machine.

Moreover, the integration of mobile technology has changed how we interact with ATMs. The ability to use smartphones to locate nearby machines, initiate transactions, or receive real-time notifications has revolutionized the way consumers approach banking. This mobile connectivity enhances accessibility, enabling users to manage their finances efficiently, regardless of location. As a result, ATMs are evolving into multifunctional banking terminals that cater to a broader range of financial services beyond mere cash dispensing.

ATM companies, like ATMgeorgia, are at the forefront of this technological shift. By focusing on both processing cash loads and the installation and de-installation of machines, these companies ensure that ATMs remain up to date and equipped with the latest features. Their commitment to innovation means that ATMs will continue to adapt to the changing needs of consumers, reinforcing their role as essential tools in everyday financial transactions.

The Future of ATM Services

As we look towards the future of ATM services, advancements in technology will continue to shape how we interact with these machines. Innovations such as contactless transactions and biometric security features are making ATMs more user-friendly and secure. This evolution not only enhances the customer experience but also attracts a broader demographic, including those who may have previously been hesitant to use cash machines.

Moreover, the role of companies like ATMgeorgia is becoming increasingly vital in this landscape. Their focus on cash load processing, installation, and de-installation ensures that ATMs are not only accessible but also stocked and functioning efficiently. As more businesses turn to ATMs to streamline transactions, the demand for reliable service providers will grow, creating opportunities for ATM companies to expand their offerings and adapt to emerging technologies.

Finally, the integration of ATMs with digital payment systems may redefine their purpose beyond just cash withdrawal. The future could see ATMs functioning as multi-channel financial service kiosks, offering services like bill payments, money transfers, and even cryptocurrency options. This evolution represents a significant shift in how consumers approach banking, further embedding ATMs into our daily lives as versatile financial hubs.